How does the Treasury perform the automatic calculation procedure for Electronic Payment?

In order to make the payment of contributions easier for the individuals responsible for making them, the Treasury General of Social Security, as of 1 September 2009, will automatically calculate, for all payments where they have not requested direct debit or they are in credit, the corresponding contributions and issue the Contribution Payment Receipt for their payment by the electronic payment method.

This new feature aims to simplify the process of acquiring a contribution payment document from the Social Security (contribution form), thereby reducing the use of the paper form from the TC1 series to occasional circumstances, as in order to be printed it requires pre-printed forms and matrix printers.

The Treasury General of the Social Security, upon receipt of the FAN file, will automatically calculate the corresponding contributions Based on the data submitted on the worker payroll report (TC2) and those on record for the Contribution Account Code in the General Affiliation File.

If the contribution document contains errors or lacks information that could prevent the processing of the electronic payment request, the user will be informed of this in the technical receipt associated with the incoming message and must send a new TC2 containing the correct information. If a new, correct TC2 is not submitted to replace the previous one, the payment of contributions relating to documents that have not been accepted for automatic calculation of electronic payment because they contain errors that prevent their processing, must be paid at the collection offices within the regulation payment period, using the contribution documents from the TC1 series.

A provisional receipt with the calculations made will be sent with the technical receipt with the result of the validation of the TC2. If there are any differences between the amount calculated by the General Treasury and the totals presented by the user in the FAN file, these will be listed in the technical receipt. The user must then present the TC2 again with the correct data.

If this new, correct document is not received, a Contribution Payment Receipt will be issued, within the established time periods, with the amount calculated by the Treasury General of the Social Security. This Contribution Payment Receipt can not only be paid over the counter at the Bank but also using other methods of payment such as cash points, telephone banking and Internet banking (depending on the availability of the Banks).

After the Contribution Payment Receipt has been issued, the document will be blocked and may not be replaced. For this reason, users are advised to submit their contribution documents in advance, so that they have sufficient time to check for errors and correct the documents submitted before the Contribution Payment Receipts are issued.

For more information on the advance issuing of "Contribution Payment Receipts" see the "Electronic Payment Transactions User Manual". This is available in the "Documentation" area, which is part of the "RED System" section on the Social Security website.

"Contribution Payment Receipts" are sent out in the same way as technical receipts and can be printed through WinSuite32. To do this, select the option "Print" from the main menu of WinSuite32 and select "Contributions".

On the contributions print screen, select the option Payment Receipts and click on "Next".

At the top of the screen a list will appear with all the files for which a "Contribution Payment Receipt" has been issued. Select a file to access the contribution documents that it contains.

To print the receipt, select the contribution document, the receipt type "Electronic Payment" and click on "See/Print".

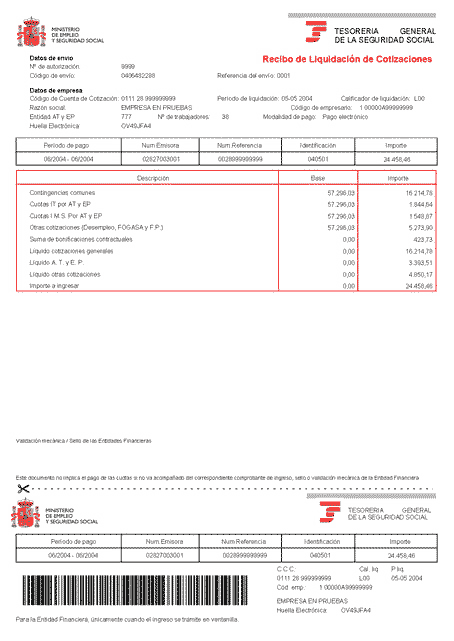

The "Contribution Payment Receipt" contains all the payment information relating to the contribution as well as the Electronic Payment account details that allow the user to make the payment through the bank using telephone banking, Internet banking or a cashpoint.

IMPORTANT: The header must be entered correctly in order for the payment to go through.

Inicio

Inicio