2021 Notices

04/01/2021- Service Cut for the Authorised Network Service, CASIA

We hereby inform you that, due to maintenance and updating work, the RED Authorised Service, CASIA (Coordination, Attention and Integral Support for the RED Authorised) will be suspended from 19.00h to 19.30h on 4 January 2021.

05/01/2021-RED News Bulletin 1/2021

The RED News Bulletin 1/2021 is now available in the RED news area. It contains the following items:

- Law 11/2020, of General State Budgets for -LPGE- in 2021. Article 119. Bases and Rates of Contribution to Social Security, Unemployment, Protection for Termination of Activity, Wage Guarantee Fund and Vocational Training during 2021.

- Law 11/2020. LPGE 2021 One Hundred and Twenty-second Additional Provision. Support measures to extend active periods for workers with permanent fixed term contracts in the tourism, commerce and hotel and catering industry sectors related to tourist activity.

- Law 11/2020. LPGE 2021 One hundred and twenty-third additional provision. Bonuses on Social Security contributions for workers whose positions change due to risk during pregnancy, breastfeeding or an occupational disease.

- Law 11/2020. LPGE 2021 Mutual Societies for Social Insurance authorised to act as alternatives to the Special Social Security Scheme for own account workers or self-employed workers.

- Number Five of the Thirty-eighth Final Provision: Change to the revised text of the General Social Security Law approved by Legislative Royal Decree 8/2015 of 30th October, Final Eighth Provision: Modification of the published text of the Law on Infractions and Sanctions in the Social Order, approved by R.D. Legislation 5/2000, of 4 August.

- Law 11/2020. LPGE 2021 Thirty-sixth Final Provision. Modification of the Consolidated Text of the Law of the Workers' Statute, approved by Royal Legislative Decree 2/2015, of 23rd October.

- Law 11/2020. LPGE 2021 Thirty-eighth Final Provision. Change to the Revised Text of the General Social Security Law approved by Legislative Royal Decree 8/2015 of 30th June.

- Law 11/2020. LPGE 2021 Forty-first Final Provision. Amendment of Royal Decree-Law 28/2018, of 28th December, for the revaluation of public pensions and other urgent measures in social, labour and employment matters.

- Law 11/2020. LPGE 2021 Forty-third Final Provision. Moratorium on the payment of social security contributions by means of deferment.

08/01/2021- Queries and Errors/Incidents Support Closed.

In order to ease management and avoid the accumulation of pending cases that cannot be resolved, from on 7-1-2021, the Consultation and Error/Incident cases will change to Closed - Ex officio when 20 calendar days have elapsed since they have been in Open - Information Requested status without the requested information or documentation having been provided.

The closure of the case will be notified by means of an e-mail sent to the address provided through the Enquiry/Contact Details Change Service.

14/01/2021- Entry values D6 and D7 of the INACTIVITY TYPE field.

The entry of values D6 and D7 of the INACTIVITY TYPE field on 01/12/2020, for the CCC workers of the CNAES referred to in article 7 of Royal Decree-Law 35/2020, of 22nd December, will foreseeably be available during the week of 18th January 2021. The availability of the mechanisation of these values will be notified by the same means.

20/01/2021- Service Cut for the CASIA RED Authorised Service.

We hereby inform you that, due to maintenance and updating work, the Service for the Network Authorised Service, CASIA (Coordination, Attention and Integral Support for the Network Authorised) is closed. It is scheduled to open throughout the morning.

01/02/2021- Notice of Closure of Services

For maintenance and application upgrades, the SLD and RED direct services are expected to be closed until 3rd February. Processing of the files will not start until that date.

02/02/2021- Hotel and Catering Notice 2021

SUPPORT PROLONGING ACTIVITY OF PERMANENT EMPLOYEES IN TOURISM, COMMERCE AND HOTEL AND CATERING SECTORS.

The one hundred and twentieth additional provision of Law 11/2020, of 30th December, on the General State Budget for 2021, establishes a 50% rebate on employer Social Security contributions for common contingencies and joint collection of Unemployment, FOGASA and Vocational Training, corresponding to permanent discontinuous workers in the tourism, commerce and hotel and catering sectors linked to the same, who carry out their productive activity during the months of February, March and November of 2021.

With the aim of enabling the calculation of this case, we hereby inform you that both the communication of the UNUSUAL CAUSE IN THE CONTRIBUTION 017 in the Contribution Account Code and the ADDITIONAL SITUATION OF AFFILIATION 420 are now available in the labour relations registers of the workers affected.

With regard to the bonuses established by Royal Decree-Law 35/2020, of 22nd December, information will be provided in due course on the authorisation of these notifications for the months of April to October 2021.

04/02/2021- Job Change Rebate Notice 2021

CHANGE OF JOB DUE TO RISKS DURING PREGNANCY OR BREASTFEEDING OR DUE TO OCCUPATIONAL DISEASE

The one hundred and twenty-third additional provision of Law 11/2020, of 31st December, on the General State Budget for the year 2021, establishes a 50% rebate on employer contributions for common contingencies, as of 1 January 2021 and for an indefinite period, in the event of a change of job for reasons of risk during pregnancy or breastfeeding or due to occupational illness.

Consequently, we inform you that the admission is now enabled, with effects equal to or after 1 January 2021, of the values 01 and 02 in the CHANGE JOB POSITION field, required for the calculation of this particular contribution.

05/02/2021- New version of SILTRA notice

It is reported that a new version of SILTRA 2.3.2 will be released on Monday, which solves the problem detected in the notifying of actual working days for the year 2021.

Please remember that SILTRA will automatically update during delivery and no manual update is necessary. However, it will also be available for download from the software area of the RED System.

12/02/2021-RED News Bulletin 2/2021

The RED News Bulletin 2/2021 is now available in the RED news area. It contains the following items:

- Royal Decree-Law (RDL) 2/2021: Art.1.1 Extension of ERTE FORCE MAJEURE Art.22 RDL 8/2020.

- RDL 2/2021. Art.1.2 ERTE BY IMPEDIMENT. First Additional Provision (DA1) Paragraph 2 RDL 24/2020. Extension

- RDL 2/2021. Art.1.3 ERTE THROUGH RDL IMPEDIMENT 30/2020. Extension

- RDL 2/2021. Art.1.4 ERTE BY LIMITATIONS. Extension

- RDL 2/2021. Art.2 ERTE DUE TO IMPAIRMENT OR LIMITATIONS. New:

- RDL 2/2021. First Additional Provision (DA 1). Companies belonging to sectors with a high coverage rate per file of Temporary Employment Regulation and a low rate of activity recovery.

- RDL 2/2021. Appendix.

- Scheme of Responsible Declarations -CPC- and Communications on workers -Inactivity Type.

- RDL 2/2021. Other Aspects.

- RDL 2/2021. Fourth Transitional Provision. Suspension of the Application of the Applicable Contribution Rates for professional contingencies and for cessation of activity of self-employed workers included in the Special Social Security Scheme for self-employed workers and in the Special Social Security Scheme for seafarers.

- New L90 settlements. Differences in Contribution Bases.

- Casia Updates:

- Closing of Query and Error/Incident type cases.

- Opening of new procedures.

- New version of the Inss-Empresas file (FIE).

- Importance of the electronic remission through the RED System, for the submission of childbirth and childcare , as well as other short-term subsidies.

- Download Response Files from the website.

- Modification of the calculation of the Regulatory Payment Period in "Retroactive payment of salaries” L03 settlements .

15/02/2021 New Service: "Service for obtaining a report on workers affected in the updating of settlements".

New Service: "Service for obtaining a report on workers affected in the updating of settlements"

RED Directo and RED SLD users are now able to access a new service "Service for obtaining a report on workers affected by an update", which allows them to request information on the workers affected by the late update of a specific SLD settlement. It is informed that detailed information concerning said service can be found in the corresponding manuals located in the following routes:

15/02/2021- "Responsible declarations and notices of Royal Decree-Law 2/2021".

Responsible declarations and notices under Royal Decree-Law 2/2021

The submission of responsible declarations and notices referred to in BNR 02/2021, in application of the provisions of Royal Decree-Law 2/2021, for the February settlement period, is expected to be available on 26th February.

01/03/2021- Notice of Service Closure

For maintenance and application upgrades, the SLD and RED Direct services are expected to be closed until 2nd March inclusive. Processing of the files will not start until that date.

08/03/2021- Notice of CASIA Closure

Due to maintenance and application updates, the Customer Service and Support Centre (CASIA) will be closed from 19:00 hours on Monday 8th March until early morning on Tuesday 9th March.

11/03/2021- CASIA Updates

- Collection Segment Opening:

The Collection segment has been opened in the list of segments available in Casia. As a result, the process of Providing documentation accrediting late updates of settlements has been renamed as "Collection". This renaming only affects cases that are opened from now on, cases that are already open will not be affected. The catalogue of collection procedures will be gradually expanded.

It is very important that the correct cataloguing of each of the procedures is respected so that they can be dealt with by the competent Service Unit.

- New sub-statuses within the Closed Status: 4 new sub-statuses have been created within the Closed Status, applicable only to procedure cases, as these cases inform the meaning of the resolution on the merits of the matter raised in the request: Upheld, partially upheld, dismissed, inadmissible.

12/03/2021- Casia Closure Notice

For maintenance and upgrades, the Customer Service and Support Centre (CASIA) will be closed on Sunday 14th March from 08.00 to 12.00 hours.

17/03/2021- Transitions from ERTE due to impairment to limitations and vice-versa

In relation to the publication of Royal Decree-Law 02/2021, of 26 January, and the consequent implementation in the General Affiliation File of the new values of Responsible Declaration and Inactivity referred to in BNR 2/2021, the following clarifications are made.

In accordance with the provisions of article 2 of the aforementioned regulation, which establishes the possibility of moving from a situation of impediment to one of limitation or vice versa, without the need to process a new temporary employment regulation file, when the company affected prior to 1 February 2021, by a temporary employment regulation file due to "Impediments" or "Limitations", moves from one situation to the other, from that date onwards, it will be necessary to present the new responsible declaration values 074- ERTE Activity Impediments Art.2 RDL 2/2021- or 075- ERTE Activity Limitations. Art.2.RDL2/2021

If, for example, the company had been affected for the period prior to February 2021 by ERTE due to "Limitations", from February onwards the CPC 068-ERTE Activity Limitations Art.2.2 RDL 30/2020-, must be filed for the period of time in ERTE due to limitations, and when transitioning to the situation of impediments, a CPC74- ERTE Activity Impediments Art.2 RDL 2/2021- must be filed with the "Date from" of this change of circumstances. Accordingly, when returning to a situation of limitations, CPC 075- ERTE Activity Limitations must be submitted. Art.2.RDL2/2021

22/03/2021- Extension of RED Data Variation Deadlines in April

| RED DEADLINES |

||

|---|---|---|

| NORMAL DEADLINE |

EXTENDED DEADLINE |

|

|

ACTUAL DAYS WORKED |

Until the 6th day of the following month to which they apply |

Until the 13th day of the following month to which they apply

|

|

Inactivity due to ERTE or strike |

Until the penultimate day of the month following the FRV*. |

It is not changed |

|

CTP strike activity/ERE |

Until the penultimate day of the month following the FRV |

It is not changed |

|

Inactivity (no ERTE or strike) |

Entry throughout the month of the FRV, within three days. |

If FRV March or from 1st to 5th April - until 8th April.

|

|

Reduced working hours/CTP |

Entry throughout the month of the FRV, within three days. |

|

|

CONTRACT TYPE/CTP |

Entry throughout the month of the FRV, within three days. |

|

| Retroactive CTP change |

In the first three days of the following month. |

|

|

Other data associated with the contract to be modified by ATR45 |

Entry throughout the month of the FRV, within three days. |

|

| Occupation. |

Entry throughout the month of the FRV, within three days. |

|

| Contribution group |

Entry throughout the month of the FRV, within three days. |

|

|

Occupational Classification |

Entry throughout the month of the FRV, within three days. |

|

|

Reduction Coefficient for Retirement Age. |

Entry throughout the month of the FRV, within three days. |

|

| SAA |

Throughout the month of the FRV. SAA 420 - in advance up to 60 days and throughout the calendar month and up to the 3rd day of the following month, taking into account the date typed by the user. |

If FRV March or 1st to 5th April - until 8th April. SAA 420:

|

Actual Date of Variation

14/04/2021- Technical stoppage SLD

Due to maintenance work on the database of the RED System, there will be a technical stoppage on the following days:

- On 16th April, between 21:00 and midnight, the SLD architecture will be halted and therefore remittances will not be processed. The SLD and RED direct services will remain open but some error may occur.

- On 18th April between 08:00 and noon, the SLD and RED Directo services will be closed.

06/05/2021- Improving CRAs' Communication

An improvement has been implemented in the communication procedure of the "CRA" Subscriber Remuneration Concepts for RED DIRECTO's authorised users.

It is possible to recover the CRAs communicated in the previous settlement period and to select one or more workers and their salaries to carry out the corresponding registration.

The Manual published on the WEB "Conceptos Retributivos Abonados (CRA)" has been updated.

06/05/2021- Notice for permanent seasonal employees Tourism, Commerce and Hotel and Catering Industry

SUPPORT PROLONGING ACTIVITY OF PERMANENT SEASONAL EMPLOYEES IN TOURISM, COMMERCE AND HOTEL AND CATERING LINKED TO 2021

The third additional provision of Royal Decree-Law 35/2020, of 22 December, on urgent measures to support the tourism, hotel and catering and commerce sector and in tax matters, establishes a 50% rebate on employer social security contributions for common contingencies, as well as for the joint collection of Unemployment, FOGASA and Vocational Training, for permanent contracts in the tourism, commerce and hotel and catering sectors linked to these, which carry out their productive activity in the months of April to October 2021.

In order to enable the calculation of this contribution incentive, we inform you that both the entry of the CAUSE FOR UNUSUAL CONTRIBUTION 017 in the Contribution Account Code and the ADDITIONAL AFFILIATION SITUATION 420 in the labour relations register of the affected workers are now enabled.

28/05/2021-RED News Bulletin 3/2021

The RED News Bulletin 3/2021 is now available in the RED news area. It contains the following items:

- Information services relating to updates of SLD settlements outside the regulatory period: "Service for Obtaining the Report on Affected Workers in the Updating of Settlements" and "Calculation Consultation Service".

- Information on supplementary debts for workers in the Special Scheme for Self-employed Workers.

- Credited Retribution Items (CRA File) New "Teleworking Expenses" Remuneration Item.

- Improvement of the communication of Paid Remuneration Items for Red Directo authorised persons.

- Obligation to keep the company's registered office and economic activity up to date (ITSS)

04/06/2021-New ERTE COVID-19 RDL 11/2021.

04/06/2021-RED News Bulletin 4/2021

The RED News Bulletin 4/2021 is now available in the RED news area. It contains the following items:

- Royal Decree-Law (RDL) 11/2021: Art.1.1 Extension of ERTE FORCE MAJEURE Art.22 RDL 8/2020.

- RDL 11/2021. Art.1.2 ERTE by Impediment. First Additional Provision (DA1) Paragraph 2 RDL 24/2020. Extension

- RDL 11/2021. Art.1.3 ERTE due to the impediment of RDL 30/2020 and RDL 2/2021.Extension

- RDL 11/2021. Art.1.4 ERTE by Limitations of RDL 30/2020 and RDL 2/2021. Extension

- RDL 11/2021. Art.2.1 ERTE due to impediment or Activity Limitations. New:

- RDL 11/2011. Art.2.2, 2.3 and 2.4. Transition from Impeditive to Limitative ERTE, and vice versa.

- RDL 11/2021. First Additional Provision (DA 1). Companies belonging to sectors with a high coverage rate per file of Temporary Employment Regulation and a low rate of activity recovery.

- RDL 11/2021. Other aspects.

- RDL 11/2021. Annotation of CPC and Inactivity types.

- Scheme of Responsible Declarations -CPC- and Communications on workers -Inactivity Type and exemption percentages.

- RDL 11/2021. Title II - Measures for the protection of self-employed workers.

- RDL 11/2021. Appendix. List of CNAE09 codes referred to in DA 1.

14/06/2021-Notice Duplicate Responses AFI Files

Due to an error in the system that generates the Affiliation Response Files (ARF) issued as a result of the processing of the Affiliation Files (AFI), the responses corresponding to the remittances processed this morning, 14 June 2021, have been sent twice. Both answers are the same, so only one of them should be taken into account.

We apologise for any inconvenience that may have been caused.

21/06/2021- Procedure Provide documentation accrediting the Existence of ERTE

It is hereby notified that the Procedure "Provide supporting documentation / Existence of ERTE", previously included in the subject "Contribution", has been re-catalogued and is now available in the subject "Affiliation, registrations and cancellations"".

01/07/2021- RED News Bulletin 5/2021

The RED News Bulletin 5/2021 is now available in the RED news area. It contains the following items:

- News on CASIA: New Functionalities:

- Opening of Cases with originating from the Social Security General Treasury.

- Opening of Queries on Collections.

- Closing of Formalities.

- New ONLINE Affiliation Functionality: Assignment of Social Security Number

- New RED ONLINE System service: FIER.

01/07/2021- RDL 11/2021: Annotation of CPC and Inactivity Types.

The submission of the responsible declarations and communications referred to in BNR 4/2021, of 4 June for the application of the provisions of Royal Decree-Law 11/2021, of 27 May, on urgent measures for the defence of employment, economic reactivation and the protection of self-employed workers, will be available from the following dates:

- Filing of responsible declarations –CPC-: 01 July.

- Communication of INACTIVITY TYPE field values and calculation of characteristics: 09 July.

Therefore, from 1 July, the responsible declarations may be filed prior to the request for the settlement of amount corresponding to June 2021.

However, the new values of the INACTIVITY TYPE field associated with the new responsible declarations –CPC- created specifically for Royal Decree-Law 11/2021 cannot be reported until 9 July, in those cases where this is appropriate.

Likewise, variations or corrections to the INACTIVITY TYPE field, created for previous Royal Decree-Laws but which are applicable during the validity of RDL 11/2021, may not be reported until 9 July.

Likewise, until 9 July, the contribution characteristics corresponding to the exemptions established in RDL 11/2021 will not be calculated. Therefore, the settlement of amounts referring to the amount for June 2021, to which contribution exemptions may be applicable, should not be confirmed until that date, provided that the responsible declaration has been previously filed and the corresponding value of the INACTIVITY TYPE field has been reported, if applicable.

09/07/2021-Incidence on ERTE-affected settlements in June 2021

It is reported that there have been problems in calculating settlements of workers affected by ERTE for June 2021, which would have been submitted between 1 and 8 July 2021. It is requested that no further action be taken on them. A new communication will be issued when the incident has been rectified.

However, the aforementioned impact does not affect settlements submitted, for the first time, as of today, for June 2021.

09/07/2021-Record Types of Inactivity

Please be advised that the possibility of recording any TYPE OF INACTIVITY value affecting the June 2021 settlement period is now available.

19/07/2021-FIE - Inclusion of self-employed workers

From 20/07/2021, information on self-employed workers included in the Special Scheme for Self-Employed Workers and in the Special Scheme for Sea Workers will be communicated in the INSS EMPRESAS (FIE) file. Following the entry into operation of version 2.0 of the FIE on 08/03/2021, self-employed workers were the only group whose inclusion in the FIE had not yet taken place, therefore, as of 20/07/2021, the FIE will cover all groups of workers.

15/09/2021-FIER - New RED Online System service as of 20/09/2021

FIER - New RED Online System service from 20/09/2021

From 20 September 2021, the new FIER service will be available in the RED Online System – see RED News Bulletin 5/2021 of 1 July 2021.

This new application allows any main or secondary user of a RED DIRECT or RED Direct Settlement System authorisation to download the information contained in version 2.0 of the INSS Companies File (FIE) in Excel format. In addition, it allows the joint download of a period of time, with a maximum of 17 days and 300 records per query.

At www.seg-social.es, in the section Red System/ INSS/ User Manuals you can consult the FIER User Manual, which details how to access the service, as well as the fields contained on the application's start screen and the actions that can be carried out. A link to the FIER User Manual is also displayed at the bottom of the FIER service screen.

Finally, we remind you that the FIE 2.0 Message registration design can be consulted at www.seg-social.es, in the section Red System/ INSS/ Technical Instructions.

23/09/2021-New consultation service for self-employed workers' quotas.

New consultation service for self-employed workers' quotas.

A new service for the "Consultation of receipts issued in the Self-Employed System" is operational in the RED System, which can be accessed from the RETA CONTRIBUTION section of the Virtual Office, and where you can obtain information on the contribution that will be debited from the self-employed worker's bank account on the last working day of the month. Specifically:

- From the 26th day of each month, it will be possible to consult the quota corresponding to that settlement period, as well as any supplementary settlements corresponding to previous periods that will be debited from the account that month.

- At any time it is possible to consult the contributions corresponding to settlement periods prior to that in which the consultation is made and which were already issued by the Social Security General Treasury for debiting to the corresponding bank account. The first settlement period for which information is available in the new service is July 2018, when the SEPA-compliant debit issuance procedure was implemented.

The information obtained through this service cannot, under any circumstances, be used as a document for the payment of contributions, nor does it certify that these contributions have actually been paid by the worker, and therefore this information does not constitute accreditation that the worker is up to date with their payment obligations to the General Treasury of the Social Security.

In addition, a Service Help Manual has been made available to RED Authorisers, located through the following routes:

01/10/2021- Notice of Service Closure

For maintenance and application upgrades, the SLD and RED Direct services are expected to be closed until 5 October inclusive. Processing of the files will not start until that date.

08/10/2021- Extension to 90 days for cancellations of TI reports

Extension to 90 days for cancellations of IT reports

It is reported that the deadline for users of a RED authorisation to cancel, via the RED Online System, sick leave, confirmation and discharge reports for temporary incapacity processes has been extended to 90 days.

15/10/2021- RED News Bulletin 6/2021

The RED News Bulletin 6/2021 is now available in the RED news area. It contains the following items:

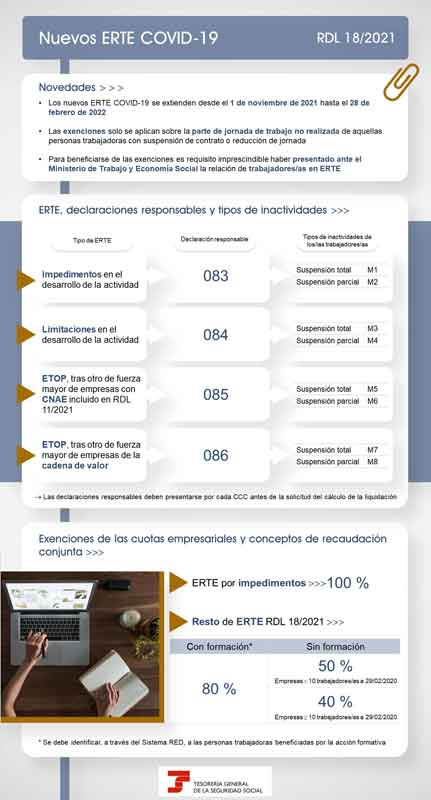

- Royal Decree-Law 18/2021 of 28 September on urgent measures for the protection of employment, economic recovery and improvement of the labour market.

- RDL 18/2021. Application of the contribution exemptions established in Royal Decree Law 11/2021 for the month of September 2021.

- RDL 18/2021. Application of the contribution exemptions established in Royal Decree Law 18/2021 for the month of October 2021.

- RDL 18/2021. Extension of ERTEs from 1 November 2021 and application of the contribution exemptions set out in Article 4 of Royal Decree Law 18/2021.

- RDL 18/2021. Identification of new ERTEs authorised or communicated with effects on or after 1 November 2021.

- RDL 18/2021. Responsible declaration on the company's commitment to carry out training actions.

- RDL 18/2021. Extraordinary measures for companies in the Canary Islands affected by the volcanic eruption in the Cumbre Vieja area.

- Scheme of responsible declarations -CPC- and communications on workers -Inactivity Type-.

- Communication on the existence of ERTE linked to the pandemic crisis in companies whose ERTE is extended as of 01-11-2021 and do not intend to apply exemptions in the contribution.

- Modifications to RED System Affiliation.

- RDL 18/2021. Title II. Measures for the protection of self-employed workers.

- RDL 18/2021. DA Sixth. Extraordinary measures for self-employed workers affected by the volcanic eruption in the Cumbre Vieja area on La Palma.

- Annex I. Title I, Title II and additional fourth, fifth, sixth and eleventh provisions and single transitional provision of RDL 18/2021.

- Appendix II. Labour Authorities.

- Appendix III. Types of ERTE.

28/10/2021-New deadlines for variations and corrections of data for users of the RED System.

New deadlines for Variations and Corrections of data for users of the RED System.

From 1 November, the variation of certain data associated with the contract and its correction, as well as corrections to the registration data, can be made through the RED System during the month to which they refer, and during the following month, until settlement is confirmed. All notifications of variations and corrections made up to that time shall take effect from the actual date communicated, without prejudice to the penalties and liabilities that may arise from the failure to communicate these variations or corrections within the regulatory period.

28/10/2021- Functionality extension Assignment of Social Security Number: Workers with NIE

Functionality extension Assignment of Social Security Number: Workers with NIE

On 6 July, a new functionality was implemented in the area of affiliation to be able to request, through the RED System, the assignment of the Social Security Number -N.S.S.- (BNR 5/2021, of 1 July).

At that time, only persons with Spanish nationality who had a National Identity Document were allowed to be assigned an N.S.S.

We hereby inform you that as of today, 28 October, this functionality has been extended for the assignment of the N.N.S. to persons who have a Foreigners' Identification Number and are nationals of one of the following countries:

Germany, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Slovakia, Slovenia, Estonia, Finland, France, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Sweden and Switzerland.

The functioning and the different controls and validation rules will be the same as they have been up to now.

Likewise, once the N.N.S. has been consolidated in the system, a duplicate of the SSN assignment documentation can be obtained.

Note* Please note that the N.S.S that cannot be assigned via this functionality must continue to be requested via CASIA, and that the schemes for which registrations will be accepted with the N.S.S., generated via the RED System, are the following:

0111 GENERAL SCHEME

0112 GEN. SCH.(ARTISTS)

0163 G.S (S.E.AGRARIAN CCC)

0811 S.S SEA(C.AJ.GR. I.)

0812 S.S SEA(C.AJ.GR.2A)

0813 S.S SEA(C.AJ.GR.2B)

0814 S.S SEA(C.AJ.GR. 3)

0821 R.E.MAR(ASIM.GR. I)

0822 S.S.SEA (ASIM.GR.2A)

0823 S.S.SEA (ASIM.GR.2B)

0911 S.S. COAL MINING

29/10/2021-New ERTEs COVID-19 RDL 18/2021.

05/11/2021- Notice of CASIA Closure

The Customer Service and Support Centre (CASIA) will be closed for maintenance and application updates from 18:30 on Friday 05.11.2021. It will be operational again from 15:00 on Saturday, 06.11.2021, Spanish mainland time.

11/11/2021- Instructions for modification RED System affiliation typo. RDL 18/2021

Instructions for modification RED System affiliation typo. RDL 18/2021

In the BNR 6/2021 of 15 October, in the section Affiliation remittances/Modification of the AFI file, information was provided on the creation of a new field DECLARATION OF RESPONSIBILITY FOR TRAINING, the values of which were 1=YES and 2=NO.

It is communicated that this is a typo and that the correct values are Y=Yes and N=No.

11/11/2021- Clarification for new deadlines for variations and corrections of data for users of the RED System.

Clarification for new deadlines for variations and corrections of data for users of the RED System.

From 1 November, the variation of certain data associated with the contract and its correction, as well as corrections to the registration data, can be made through the RED System throughout the month to which they refer, and during the following month until the settlement is confirmed. All variations/corrections made up to that time will be considered on time, and no machining will be allowed after that date.

The extension of the deadline for the variation of the rest of the data since 1 November and the data for which it will be available soon is foreseen. Once the extension of the deadline for the latter has been made available, information will be provided in due course.

However, it must be remembered that until the end of the regulatory period for submitting settlements, there is the possibility of rectifying or cancelling the settlement depending on the time of the month, in order to make the variation and allow the settlement with the new data.

The rest of the RED System deadlines - registrations, cancellations, mechanisation of actual working days, elimination of consolidated registrations and cancellations, etc. - remain unchanged.

| DEADLINES VARIATIONS | ||

|---|---|---|

| CURRENT DEADLINE | NEW DEADLINE | |

| ACTUAL DAYS WORKED | Until the 6th day of the following month to which they apply. | Until the 13th day of the following month to which they apply. |

| Inactivity due to ERTE or strike | Until the penultimate day of the month following the FRV*. |

Until settlement confirmation Effective from 01.11.2021 |

| CTP strike activity/ERE | Until the penultimate day of the month following the FRV. |

Until settlement confirmation Effective from 01.11.2021 |

| Inactivity (no ERTE nor strike) | Entry throughout the month of the FRV, within three days. |

Until settlement confirmation Inactivities 7, 8, 9 and A - at any time. Effective from 01.11.2021 |

| Reduced working hours/CTP | Entry throughout the month of the FRV, within three days. |

Until settlement confirmation Effective from 01.11.2021 |

| CONTRACT TYPE/CTP | Entry throughout the month of the FRV, within three days. |

Until settlement confirmation Effective from 01.11.2021 |

| Retroactive CTP change | In the first three days of the following month. |

Until settlement confirmation Effective from 01.11.2021 |

| Other data associated with the contract to be modified by ATR45 | Entry throughout the month of the FRV, within three days. |

Until settlement confirmation Effective from 01.11.2021 |

| Occupation | Entry throughout the month of the FRV, within three days. | Until settlement confirmation Occupation C - at any time Coming soon |

| Trading Group | Entry throughout the month of the FRV, within three days. | Until settlement confirmation Coming soon |

| Daily Trading Group code | If the variation is communicated within the first three days of the month, it may refer to the 1st of the previous month or the 1st of the same month; if the variation is communicated after the first three days of the month, the variation date must always be the 1st of the same month. |

Until settlement confirmation Coming soon The RVF must always refer to the first day of the month. |

| Occupational Classification |

Entry throughout the month of the FRV, within three days. |

Until settlement confirmation Coming soon |

| Reduction Coefficient for Retirement Age. |

Entry throughout the month of the FRV, within three days. |

Until settlement confirmation Coming soon |

| SAA |

Throughout the month of the FRV. SAA 420 - in advance up to 60 days and throughout the calendar month and up to the 3rd day of the following month, taking into account the date typed by the user. |

Until settlement confirmation SAA 001- Throughout the month of the FRV. |

* Actual Date of Variation

18/11/2021- RDL18/2021: Implementation of Responsible Declarations for November 2021.

RDL18/2021: Implementation of Responsible Declarations for November 2021.

We hereby inform you that the submission of the responsible declarations and communications referred to in BNR 6/2021, 15 October, in application of Royal Decree Law-RDL- 18/2021, of 28 September, for the November 2021 settlement period, will foreseeably be available from 26 November 2021.

As an exception, the application of exemptions for companies affected by the fifth Additional Provision of RDL 18/2021 establishing extraordinary measures for companies in the Canary Islands affected by the volcanic eruption in the Cumbre Vieja area, must continue to be carried out through the channel established up to now - communication through CASIA - Requestfor processing; Subject: Affiliation, registrations and deregistrations; category: Variation of data for employed persons; Subcategory: DR ERTE La Palma-. Once the specific responsible declarations and communications for this type of temporary employment regulation procedure are available, as reported in BNR 6/2021, 15 October, they will be communicated in due course.

25/11/2021- RDL18/2021: Responsible Declarations and inactivities for November 2021

We hereby inform you that the submission of responsible declarations and inactivity communications is now available, in application of RDL 18/2021, corresponding to the November 2021 settlement period, with reference to the following CPC values and their inactivities:

062, 067, 068, 069, 070, 071, 072, 073, 074, 075, 076, 077, 078, 079, 080, 081

The submission of responsible declarations and communications corresponding to the settlement period of November 2021, in reference to the new values of CPCs and their inactivities will be available from tomorrow, Friday 26 November:

083, 084, 085, 086, 091, 092

It is reminded that, as indicated in BNR 6/2021, as of the November settlement period, for the admission of responsible declarations and communication of inactivity values for the identification of workers, it is necessary to have submitted the list of workers included in the ERTE through the website of the Ministry of Labour and Social Economy.

If this information has not been submitted to the Ministry of Labour and Social Economy within the period and in the manner established in the fourth additional provision of RDL 18/2021, the General Treasury of the Social Security - TGSS - will not be able to apply exemptions in the contribution or the special contribution 17 or 18 on the non-existence of the obligation to pay the workers' contribution, in the contributions accrued as of 1 November 2021.

Likewise, it is reminded that for the TGSS to apply exemptions from 1 November 2021, it will be necessary to expressly indicate this, in any case, both at CCC level - COMPANY EXEMPTIONS APPLICATION - and at worker level - WORKER EXEMPTIONS APPLICATION-.

Finally, it will also be necessary to present the responsible declaration of training for the application of the 80 percent exemption referred to in sections 1.a)2 and 1.b)2 of article 4 of RDL18/2020.

01/12/2021- RDL18/21: Issue detected in relation to workers on ERTE presented to the Ministry of Labour and Social Economy on 27 and 28 October and 3 November.

RDL18/21 Issue detected in relation to workers on ERTE presented to the Ministry of Labour and Social Economy on 27 and 28 October and 3 November.

An issue has been detected in the exchange of data with the Ministry of Labour and Social Economy, regarding the list of workers included in the ERTE presented at its Electronic Headquarters on 27 and 28 October and 3 November, which is preventing the admission into the system of the responsible declarations with the error "ERTE not authorised".

Once the incident has been resolved, it will be duly communicated so that the aforementioned responsible declarations can be resubmitted.

01/12/2021- Identification ERTES ETOP or FM Article 47 ET.

Identification ERTES ETOP or FM Article 47 ET.

Having assessed the appropriateness of identifying the companies that are holders of employment regulation proceedings for economic, technical, organisational or production reasons or due to force majeure referred to in article 47 of the Workers' Statute, as well as the workers and periods of suspension of the work contract or reduction of the working day as a consequence of said proceedings, in accordance with the procedure enabled for the identification of the ERTEs established as a consequence of the health crisis derived from COVID-19, we inform you that from 1 December 2021 the values of the field TYPES OF INACTIVITY B, C, D, E, F, G, M or N and the situation code low 69 - LEAVE TEMPORARY SUSPENSION ERE will NOT be admissible.

Information will soon be provided on the procedure to be followed to identify the CCCs and workers affected by these files, consisting of new values for the CPC and TYPE OF INACTIVITY fields, which will in any case be available for communication for the December settlement period.

10/12//2021- RED News Bulletin 7/2021

The RED News Bulletin 7/2021 is now available in the RED news area. It contains the following items:

- Ex officio update of payment settlements: Information referral procedure.

- Relief workers. Amendments to the area concerning contributions

- Assignment of social security number Workers with NIE

- Fier - new online RED system

- Measures to support the cultural sector. Law 14/2021 of 11 October amending Royal Decree-Law 17/2020 of 5 May.

- Time limits within which variations of data will be admitted through the network system. Communications after the statutory deadline. Effective.

- Law 6/2017, of 24 October, on urgent reforms of self-employment.

- Modifications to RED System Affiliation.

- New version of Siltra Changes in the area of affiliation

- (Article 10 of royal decree-law 20/2021). Contribution deferrals

- (Article 10 of royal decree-law 20/2021). Moratorium.

- Workers with discontinuous permanent contracts in the tourism, commerce and hospitality sectors linked to tourist activity.

- Identification of workers excluded from certain contingencies or benefits. Vessel" data in the special scheme for the sea.

- Identification of layoffs due to economic, technical, organisational and production causes and force majeure layoffs under article 47 of the Workers' Statute.

- Order PCM/1238/2021. Instructions for the procedure for the entry and stay of third-country nationals working in the audiovisual sector. Assignment of Social Security number

- Order ESS/1353/2021, of 2 December, which develops the legal regulations for social security contributions, unemployment, protection for cessation of activity, wage guarantee fund and professional training for the year 2021.

13/12/2021- RDL18/21: Resolved issue in the ERTE workers' relation presented to the Ministry of Labour and Social Economy on 27-28 October and 3 November.

We inform you that has rectified the incident referred to in the notice published on 30 November, with the subject "RDL18/21. Incidence detected in relation to workers in ERTE presented to the Ministry of Labour and Social Economy on 27 and 28 October and 3 November", so it will already be admissible to present the responsible declarations in respect of the affected CCCs.

13/12/2021- Stoppage of settlement processing.

It is reported that there has been a technical incident preventing the processing of settlements since the early hours of Saturday morning. We hope that this will be rectified this morning.

The resumption of the processing of settlements will be reported.

13/12/2021- Resuming of the processing of settlements.

Resuming of the processing of settlements.

It is reported that the incident has been rectified and the processing of settlements has started.

16/12/2021- Settlement Processing Stoppage

Settlement Processing Stoppage

Please be informed that there will be a technical stop due to the implementation of new functionalities which will prevent the processing of settlements. Processing will resume today.

17/12/2021- What's New Affiliation Remittance Processing

NEWS PROCESSED AFFILIATION REMITTANCES

Please be informed that as of 18 December, we will start processing affiliation files (AFI) seven days a week, as well as the consolidation of previous movements. Corresponding answers will therefore be issued every day of the week.

The processing of consignments will be carried out daily at the same times as at present: 7:00, 14:00 and 19:00.

29/12//2021- RED News Bulletin 8/2021

It can be found in the RED News area of the RED News Bulletin 8/2021 which includes the following section:

- Second Transitional Provision of Order PCM/1353/2021 , which develops the legal regulations for social security contributions, unemployment, protection for cessation of activity, wage guarantee fund and professional training for the year 2021.

29/12/2021 ERTES 47 ET and ERTES Cumbre Vieja volcanic eruption

ERTES 47 ET and ERTES Cumbre Vieja volcanic eruption

We inform you that the new values of the new field CAUSE OF UNUSUAL CONTRIBUTION and of the field TYPE OF INACTIVITY are now available for the identification of the ERTES due to economic, technical, organisational and production causes and ERTES due to force majeure of article 47 WORKERS' STATUTE, as well as the new values for the application of the extraordinary measures for the companies of the Canary Islands affected by the volcanic eruption registered in the area of Cumbre Vieja contained in the fifth additional provision of RDL 18/2021, and reported in the BNR 06/2021 and 07/2021.

IDENTIFICATION OF ERTES (LAY-OFFS) DUE TO ECONOMIC, TECHNICAL, ORGANISATIONAL AND PRODUCTION CAUSES AND FORCE MAJEURE ERTES UNDER ARTICLE 47 OF THE WORKERS' STATUTE.

From the 12-2021 settlement period, companies that have temporary redundancy plans for economic, technical, organisational or production reasons or due to force majeure, as referred to in article 47 of the Workers' Statute, must notify the existence and maintenance of the temporary ERTE, in accordance with the same procedures established for the presentation of the responsible declarations for the application of exemptions, with CPC code values equal to:

- 087: ERTE ETOP ARTICLE 47 STATUTE OF WORKERS

- 88: FORCE MAJEURE ARTICLE 47 WORKERS' STATUTE

The notification of the existence and maintenance of these ERTES must be made on a monthly basis, and the following data must be completed:

- CCC It must be the one in which the workers affected by the ERTE are employed.

- The DATE FROM: shall be equal to or later than 01-12-2021. It must coincide with the start date of the ERTE in the CCC or with the first day of each month thereafter.

- DATE UNTIL: shall be the last day of the month in question or the date of termination of the ERTE.

The identification of the periods of suspension of work contracts or reduction of working hours of the workers affected by the ERTE identified through CPC 087 or 088, shall be carried out through the following values of the TYPE OF INACTIVITY field:

- 087: ERTE ETOP ARTICLE 47 STATUTE OF WORKERS

- 11: ERTE ETOP ART. 47 E.T. REDUCTION WITHOUT UNEMPLOYMENT BENEFIT

- 12: ERTE ETOP ART. 47 E.T. SUSPENSION WITH UNEMPLOYMENT BENEFIT

- 13: ERTE ETOP ART. 47 E.T. REDUCTION WITH UNEMPLOYMENT BENEFIT

- 088: FORCE MAJEURE ARTICLE 47 WORKERS' STATUTE

- 15: ERTE FM ART. 47 E.T. REDUCTION WITHOUT UNEMPLOYMENT BENEFIT

- 16: ERTE FM ART. 47 E.T. SUSPENSION WITH UNEMPLOYMENT BENEFIT

- 18: ERTE FM ART. 47 E.T. REDUCTION WITH UNEMPLOYMENT BENEFIT

The values 12, 13, 16 and 18 of the INACTIVITY TYPE field:

- They must be communicated in respect of workers who are in receipt of unemployment benefit. For workers identified with these values, the obligation to pay the employer's contribution will be maintained for the part of the working day that is suspended - contribution specialities 17 or 18 - and the full contribution for the part of the working day that is worked.

- In the settlement of contributions corresponding to the accrual period of December 2021, the contribution peculiarities 17 or 18 will not be applied to workers who continue to be identified with the values of the TYPE OF INACTIVITY field E,F,G.

The values 11 and 15 of the INACTIVITY TYPE field:

- They must be reported for workers who are NOT in receipt of unemployment benefit.

- For workers identified with values 11 and 15, contributions are only payable on the part of the working day (total contribution).

- Values 11 and 15 will not generate permanence for the suspended part of the activity.

Leave key 69- LEAVE TEMPORARY SUSPENSION ERE:

- Finally, the identification of workers who, as a consequence of NOT being beneficiaries of unemployment benefits, must leave during situations of contract suspension, must be carried out with the notification of leave code 69-BAJA SUSPENSION TEMPORARILY ERE.

- Given that the cancellation code 69 has temporarily not been admissible, the notifications of cancellation of workers with code 69 through the RED System, from this moment and throughout the month of January 2022, corresponding to the settlement period of December 2021 will be considered on time (FRB=FEB).

Finally, remember that the entry of INACTIVITY TYPES B, C, D, E, F, G, M and N will not be admissible since 01-12-2021.

RDL 18/2021. EXTRAORDINARY MEASURES FOR COMPANIES IN THE CANARY ISLANDS AFFECTED BY THE VOLCANIC ERUPTION IN THE CUMBRE VIEJA AREA.

From the 12-2021 settlement period, companies will be able to access the application of extraordinary measures for companies in the Canary Islands affected by the volcanic eruption recorded in the Cumbre Vieja area, by submitting the values of the CAUSE FOR UNUSUAL CONTRIBUTION field and the TYPE OF INACTIVITY field created specifically for this purpose via the RED System. From this moment onwards, it will not be necessary to request and communicate the file via CASIA.

In order to comply with this procedure, the responsible declarations to be submitted shall be identified as follows:

- 089: ERTE FOR VOLCANO ERUPTION LIMITATIONS D.A.5 RDL 18/2021

- 090: ERTE DUE TO VOLCANIC ERUPTION LIMITATIONS D.A.5 RDL 18/2021

The notification of the existence and maintenance of these ERTES must be made on a monthly basis, and the following data must be completed:

- FROM DATE: Mandatory data. Must be equal to or later than 01-12-2021. It must coincide with the start date of the ERTE in the CCC or with the first day of each month thereafter.

- UNTIL DATE: Mandatory data. MONTH and YEAR must be the same as FROM DATE. The DAY must be equal to or later than the DAY of the FROM DATE. The UNTIL DATE shall not be later than 28-02-2022.

- CCC It must be the one in which the workers affected by the ERTE are located, and in any case, in the provinces of LAS PALMAS (35) or TENERIFE (38).

The identification of the periods of suspension of work contracts or reduction of working hours of the workers affected by the ERTE identified through the responsible declarations 089 or 090, will be the following:

- 089: ERTE FOR VOLCANO ERUPTION LIMITATIONS D.A.5 RDL 18/2021

- M9: TOTAL SUSPENSION. ERTE IMPEDIMENT. VOLCANIC ERUPTION D.A.5 RDL 18/2021.

- N1: PARTIAL SUSPENSION. ERTE IMPEDIMENT. VOLCANIC ERUPTION D.A.5 RDL 18/21.

- 090: ERTE DUE TO VOLCANIC ERUPTION LIMITATIONS D.A.5 RDL 18/2021

- N2: TOTAL SUSPENSION. ERTE LIMITATION. VOLCANIC ERUPTION D.A.5 RDL 18/2021.

- N3: PARTIAL SUSPENSION. ERTE LIMITATION OF VOLCANIC ERUPTION D.A.5 RDL 18/2021

We also inform you that the application of exemptions must be expressly indicated in the fields APPLICATION OF COMPANY EXEMPTIONS and APPLICATION OF WORKER EXEMPTIONS, in the same way as is already being done for the rest of the ERTES of RDL18/2021.

Inicio

Inicio