2008/8 de 19 de novembre de 2008

Aplicació de les bonificacions previstes a la Llei 44/2007, de 13 de desembre, per a la regulació del Règim de les Empreses d'Inserció

L'article 16.3 de la Llei 44/2007, de 13 de desembre, contempla les bonificacions següents per a les empreses d'inserció:

- Bonificacions a les quotes de la Seguretat Social, en els contractes de treball de les persones referides a l'article 2, de 70,83 euros/mes (850 euros/any) durant tota la vigència del contracte, o durant tres anys en cas de contractació indefinida.

- S'aplicarà allò establit a la Llei 43/2006, de 29 de desembre, quant als requisits que han de complir els beneficiaris, les exclusions en l'aplicació de les bonificacions, quantia màxima, incompatibilitats o reintegrament dels beneficis.

Aquestes bonificacions es reflectiran en el TC2 (fitxer FAN), mitjançant clau de deducció CD22 “Bonificacions quantia fixa” i Col·lectiu de Peculiaritat de cotització (camp 1269 del segment DAT), 1304 “Exclusió Social/Itinerari d'Inserció”.

Aquestes bonificacions es poden presentar a partir de l’1 de desembre de 2008. No obstant això, a WinSuite32 no estaran implementades fins a la propera versió, la publicació de la qual s’indicarà en un pròxim Butlletí de Notícies RED.

Instruccions per a la presentació i liquidació de quotes de treballadors inclosos en Codis de Compte de Cotització de Col·legis Concertats per les retribucions percebudes fora del concert

Actualment, els Centres Educatius Concertats disposen de dos Codis de Compte de Cotització, un per reflectir la cotització dels treballadors inclosos en el concert i un altre per reflectir la cotització dels treballadors no inclosos en el concert.

No obstant això, ja fa temps que es planteja el problema sobre la forma de cotitzar les remuneracions que el centre abona als treballadors inclosos en el concert per complements retributius aliens a aquest.

Per resoldre aquesta situació s'ha de sol·licitar a la Tresoreria General de la Seguretat Social, a partir de l'1 de desembre de 2008, un nou Codi de Compte de Cotització per reflectir la cotització per aquestes remuneracions abonades fora del concert.

El nou Codi de Compte de Cotització presenta com a particularitat que no admet treballadors en situació d'alta, ja que aquests figuren en el sistema en el Codi de Compte de Cotització vinculat al concert.

Les remuneracions alienes al concert es liquiden en el nou Codi de Compte de Cotització mitjançant liquidació L09, que cal que es presente dins del termini reglamentari d'ingrés. Aquests Codis de Compte de Cotització no admeten liquidacions L00 (ordinàries).

Per tant, a partir de l'1 de desembre, els Centres Educatius Concertats han de tenir tres Codis de Compte de Cotització pels quals han de presentar les liquidacions següents:

- Amb el CCC corresponent als treballadors inclosos en el Concert: Liquidació L00

- Amb el CCC creat per cotitzar pels treballadors inclosos en el concert les remuneracions alienes a aquest: Liquidació L09

- Amb el CCC corresponent als treballadors no inclosos en el Concert: Liquidació L00.

Nova funcionalitat d'Afiliació: Informe sobre el nombre anual mitjà de treballadors en situació d'alta

Els propers dies s'incorporarà al Sistema RED una nova funcionalitat que permetrà obtenir el certificat sobre el nombre anual mitjà de treballadors empleats a l'empresa durant els tres darrers anys, segons estableix l'article 47.8.e) del Reial Decret 1098/2001, de 12 d'octubre, pel qual s'aprova el Reglament General de la Llei de Contractes de les Administracions Públiques.

Fins a la publicació de la nova versió de WinSuite32, prevista per a finals de desembre, aquesta funcionalitat només estarà disponible mitjançant la modalitat d'Afiliació En línia.

La nova transacció En línia serà l'ACR98 - Informe nombre anual mitjà de treballadors

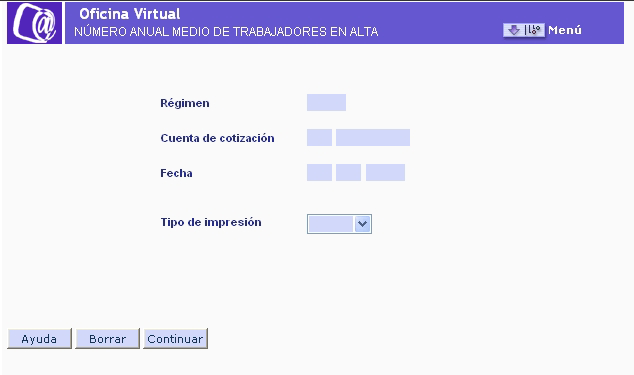

En seleccionar la transacció apareixerà la pantalla següent:

S'haurà d'introduir-hi el Codi de Compte de Cotització l'informe del qual es vol obtenir i la data a la qual s'ha de referir l'informe.

La data des de l'informe obtingut, sempre serà de tres anys abans, o del període existent.

A més, cal seleccionar el tipus d'impressió que es desitja: diferit, si el que es vol és rebre l'informe a través del correu electrònic; En línia, si el que es vol és obtenir l'informe en pantalla en temps real.

Afiliació trameses

Per obtenir el certificat mitjançant la modalitat de tramesa, s'ha creat una nova acció a nivell d'empresa: NMT- Nombre Mitjà de Treballadors.

Els registre que s'hauran d'emplenar per a aquesta acció seran:

EMP O

RZS O

EXC C

FCE O

Al registre FCE s'ha d'emplenar el camp 'Data d'inici' amb la data des de la qual es vol obtenir l'informe, que s'emet des d'aquesta data fins a tres anys enrere, o fins al període existent.

Butlletí de Notícies RED 2008/8

| Documentos | Descàrrega | Fecha |

|---|---|---|

| 110382 Butlletí de Notícies RED 2008/8 |

|

12/08/2010 |

Instruccions per a l’aplicació de la Resolució, del 10-10-2008, de la TGSS sobre autorització per a diferir el pagament de les quotes empresarials de la Seguretat Social i per conceptes de recaptació conjunta

Mitjançant Resolució de 10 d'octubre de 2008, de la Tresoreria General de la Seguretat Social, s'estableix que:

- “Les empreses que exercisquen la seua activitat en el sector del transport aeri, CNAE 62100 i 62200, amb treballadors en situació d'alta pels quals han de cotitzar a la Seguretat Social i que es troben al corrent en el compliment de les seues obligacions amb la Seguretat Social, poden sol·licitar autorització per a diferir durant nou mesos el termini reglamentari d'ingrés de la totalitat de les quotes empresarials de la Seguretat Social i pels conceptes de recaptació conjunta corresponents a liquidacions ordinàries dels períodes de liquidació d'octubre de 2008 a juny de 2009, i que cal que ingressen, mensualment, des del mes d'agost de 2009 fins l'abril de 2010.”

- "Les empreses que obtinguen aquesta autorització hauran de descomptar i retindre les aportacions corresponents als treballadors i ingressar el seu import dins del termini reglamentari per al seu pagament."

INSTRUCCIONS PER A L'APLICACIÓ DE LA RESOLUCIÓ

- Presentació de sol·licituds d’ajornament de les quotes

Les sol·licituds s'han de presentar a la seu de la Direcció Provincial o Administració de la Seguretat Social corresponent al Codi de Compte de cotització principal de l'empresa, o de la que haja autoritzat la gestió centralitzada de les funcions de recaptació.

La resolució mitjançant la qual s'autoritze a diferir el termini reglamentari d'ingrés comprendrà les quotes corresponents al període de liquidació que, a la data de la sol·licitud, encara es troben en termini reglamentari d'ingrés.

- Presentació de documents de cotització a través del Sistema RED

Les empreses del transport aeri autoritzades a l’ajornament de les quotes empresarials han de presentar els documents de cotització seguint les instruccions que es faciliten a continuació:

- L'arxiu FAN no patix cap modificació. S'haurà de presentar la relació nominal de treballadors per la totalitat de les bases, bonificacions i reduccions. Els segments totalitzadors (EDTTT) hauran d'omplir-se calculant la totalitat de les quotes degudes (quota obrera i quota empresarial). Per tant, al fitxer FAN s'indicaran les quotes totals, sense tindre en compte l'ajornament de la quota empresarial.

- Per a les empreses que sol·liciten el càrrec a compte o el pagament electrònic, el Sistema calcula automàticament el Rebut de Liquidació de Cotitzacions corresponent a l'aportació dels treballadors. Aquest Rebut de Liquidació de Cotitzacions s'ha de fer efectiu en el termini reglamentari d'ingrés (sense tenir en compte l'ajornament, ja que aquest només afecta la quota empresarial).

- No s'aplicarà el diferiment i, per tant, es calcularà la totalitat de les quotes (obrera més empresarial) en les liquidacions que resulten saldo creditor, així com en les que, encara que el resultat total siga a ingressar, l'import de la quota empresarial resulte a percebre.

- Les empreses que no s'acullen a les modalitats de pagament i ingressen la quota obrera mitjançant el butlletí de cotització TC1, cal que consignen a la casella "Classe de Liquidació i Clau de Control" (CLCC) el codi 1-08.

- En tots dos casos, tant per a les empreses que realitzaren l'ingrés de la quota obrera a través de les modalitats de pagament, com per a les que van realitzar l'ingrés mitjançant butlletí de cotització TC1, hauran d'ingressar la quota empresarial en els 9 mesos següents al termini reglamentari d'ingrés, mitjançant butlletí de cotització TC1, que contindrà les quotes empresarials diferides, així com les compensacions de pagament delegat, bonificacions i reduccions. Aquest butlletí s'haurà de codificar amb classe de liquidació i clau de control 2-08.

Aquest TC1 corresponent a la quota empresarial (2-08) NO ha d’anar acompanyat de la Relació Nominal de Treballadors (TC2)

Treballem per implementar un servei que permeta obtindre els Rebuts de Liquidació de Cotitzacions corresponents a la quota empresarial ajornada (primer mes d’ingrés, agost del 2009, liquidacions corresponents a octubre de 2008). Una vegada s'haja implementat, s'informarà mitjançant el Butlletí de Notícies RED.

- Només procedeix l'ajornament de les liquidacions ordinàries (L00) presentades en el termini reglamentari. No es pot sol·licitar l'ajornament de les quotes de les liquidacions complementàries.

- Les modificacions necessàries per a calcular automàticament la quota obrera estaran operatives a partir de l'1 de desembre (període de liquidació de novembre de 2008).

Respecte al període de liquidació d'octubre de 2008 (presentació al novembre), considerant que el sistema no estarà operatiu fins al desembre de 2008, les empreses autoritzades a l’ajornament de les quotes que desitgen ingressar aquest mes només la quota obrera, han de presentar el TC2 (fitxer FAN) sense sol·licitud de modalitat de pagament, i ingressar la quota obrera mitjançant el TC1 de paper codificat amb clau 1-08.

- L'arxiu FAN no patix cap modificació. S'haurà de presentar la relació nominal de treballadors per la totalitat de les bases, bonificacions i reduccions. Els segments totalitzadors (EDTTT) hauran d'omplir-se calculant la totalitat de les quotes degudes (quota obrera i quota empresarial). Per tant, al fitxer FAN s'indicaran les quotes totals, sense tindre en compte l'ajornament de la quota empresarial.

- Empreses que no presenten la relació nominal de treballadors a través del Sistema RED

Per a les empreses del transport aeri autoritzades a l’ajornament de les quotes empresarials que no presenten la Relació Nominal de Treballadors a través del Sistema RED és requisit imprescindible la presentació davant l’Administració de la Seguretat Social corresponent de la Relació Nominal de Treballadors (TC2) i dos TC1, un corresponent a la quota obrera i l'altre corresponent a la quota empresarial.

L'Administració segellarà i codificarà els TC1 amb les claus 1-08 (quota obrera) i 2-08 (quota patronal).

Cal que l'empresa faça efectiu el TC1 a l'Entitat Financera corresponent, sense acompanyar la Relació Nominal de Treballadors (TC2).

Inicio

Inicio